line = [None] * 28

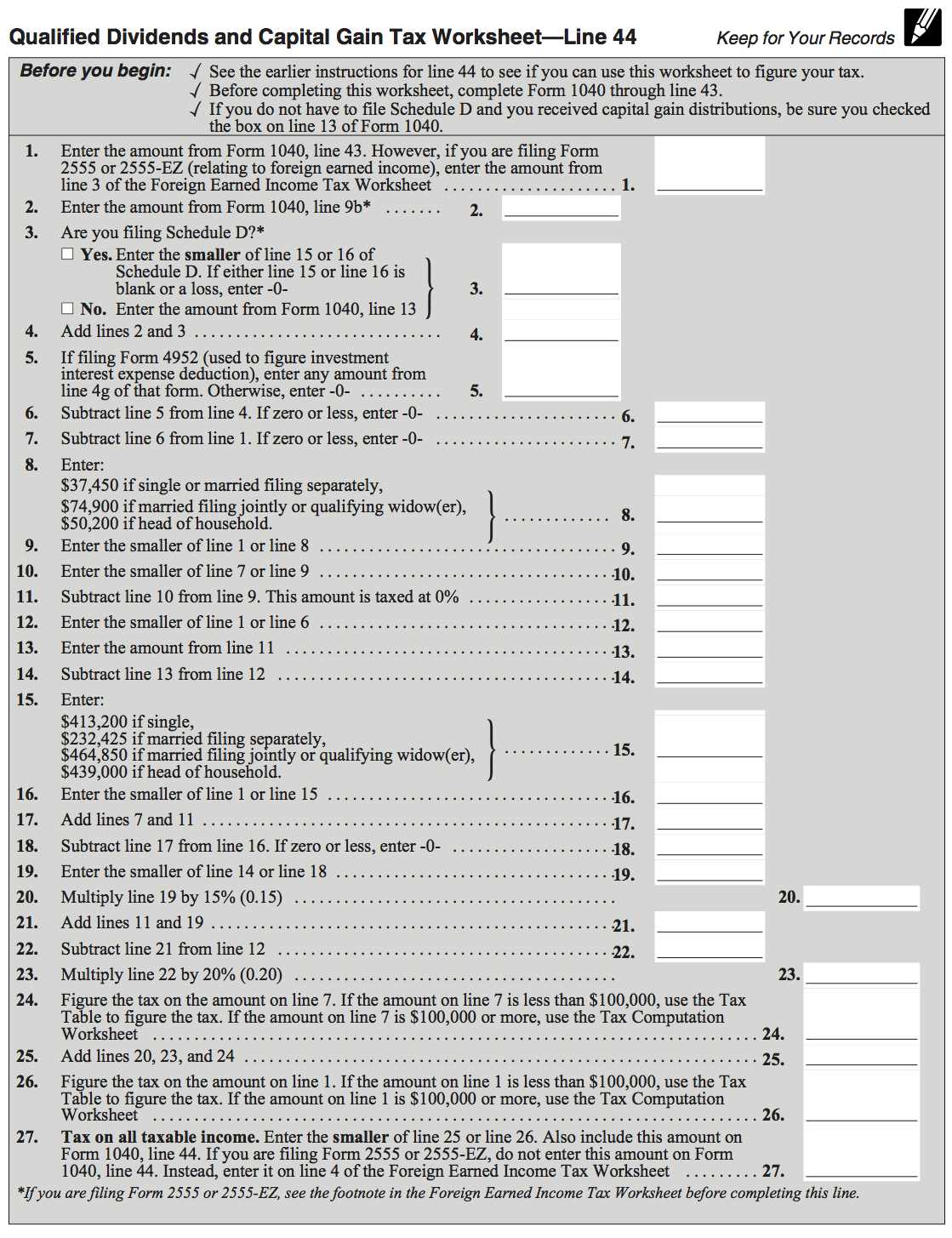

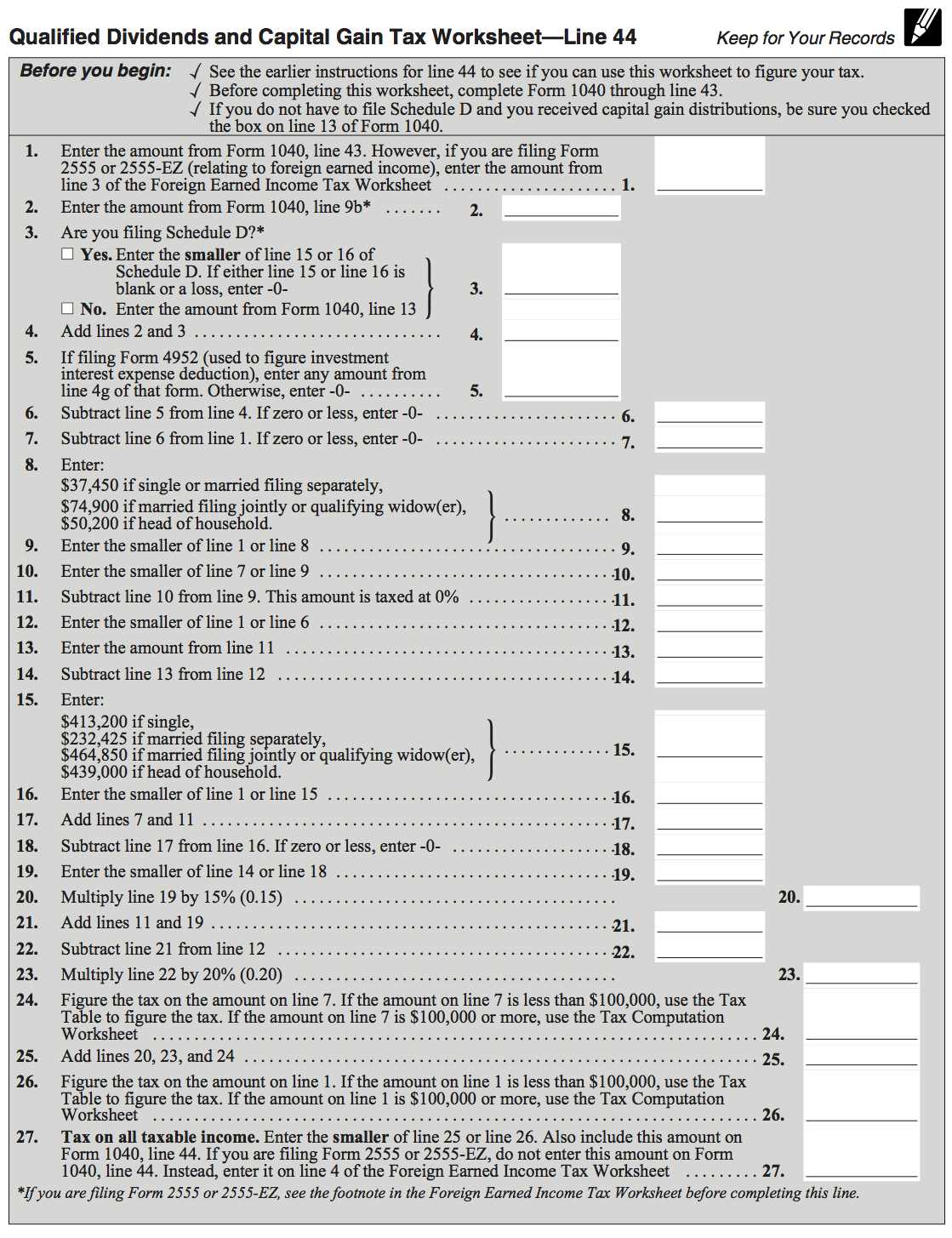

line[ 0] = 0.00 # unused

line[ 1] = XXXX # 1040 line 43

line[ 2] = XXXX # 1040 line 9b

line[ 3] = XXXX # 1040 line 13

line[ 4] = line[ 2] + line[ 3]

line[ 5] = XXXX # 4952 line 4g

line[ 6] = line[ 4] - line[ 5]

line[ 7] = line[ 1] - line[ 6]

line[ 8] = XXXX # from worksheet

line[ 9] = min(line[ 1],line[ 8])

line[10] = min(line[ 7],line[ 9])

line[11] = line[9] - line[10]

line[12] = min(line[ 1],line[ 6])

line[13] = line[11]

line[14] = line[12] - line[13]

line[15] = XXXX # from worksheet

line[16] = min(line[ 1],line[15])

line[17] = line[ 7] + line[11]

line[18] = line[16] - line[17]

line[19] = min(line[14],line[18])

line[20] = 0.15 * line[19]

line[21] = line[11] + line[19]

line[22] = line[12] - line[21]

line[23] = 0.20 * line[22]

line[24] = XXXX # from tax table

line[25] = line[20] + line[23] + line[24]

line[26] = XXXX # from tax table

line[27] = min(line[25],line[26])

i = 0

for l in line:

print('{:>2} {:10.2f}'.format(i, l))

i += 1

This is a quick-and-dirty first cut, just good enough for what I

needed this weekend. It requires some user input, as I have to

manually enter values from other forms, from the case statements,

and from the tax table. Several of these steps could be automated,

with only a bit more effort or a couple of